NUWAY Alliance, a major Minneapolis-based addiction and behavioral health treatment nonprofit, recently agreed to pay $18.5 million to settle allegations that it defrauded Medicaid by dangling housing subsidies to lure patients into taxpayer-funded treatment, then double-billing for the care they supposedly received—sometimes twice for the same therapy session. The nonprofit admitted no wrongdoing but will now operate under a five-year federal compliance agreement, with third-party oversight.

Officials estimate Arizona’s behavioral health billing scandal cost taxpayers $2.8 billion.

Federal prosecutors say the scheme cost taxpayers millions and eroded the integrity of programs meant to support the vulnerable, while critics warn that NUWAY is only the tip of a very large, very expensive iceberg: The behavioral health sector is now a top offender in the $100 billion-a-year world of healthcare fraud, much of it driven by so-called treatment providers faking services, exploiting the poor—and billing for care that never happened.

“When someone steals from Medicaid, they are both stealing from taxpayers and stealing money meant to pay for poor people’s health care,” said Minnesota Attorney General Keith Ellison, calling NUWAY’s conduct “disgraceful.” His office will receive more than $8 million from the settlement—enough to fund the state’s Medicaid Fraud Control Unit for over five years.

But if Ellison wants to keep that office busy, he won’t have to look far. A national survey of recent Medicaid fraud cases reads like a hall of shame for the behavioral health industry: a Connecticut counseling center called “Miracles to Destiny” that never delivered a single miracle—or counseling session; a North Carolina behavioral clinic that billed Medicaid for treating patients who were literally dead; and a psychiatrist in Connecticut who became the favorite “dealer” of addicts, writing prescriptions while billing Medicare and Medicaid for roughly 45-minute sessions that lasted as low as five.

The fraud often hides behind buzzwords like “recovery,” “wellness” and “access.” What’s actually happening is far grubbier. In NUWAY’s case, prosecutors said the nonprofit subsidized clients’ rent (up to $700 a month) on the condition they attend its intensive outpatient programs, treatment largely paid for by Medicaid. While housing help may sound compassionate, the deal amounted to an illegal kickback: Patients got a roof over their heads only if they let NUWAY bill Medicaid on their behalf.

That practice occurs elsewhere in the Twin Cities—and beyond. In St. Paul, Evergreen Recovery faced an FBI raid last year for a similar “you stay, we bill” model. In Arizona, things got so bad that the state suspended payments to over 250 behavioral health providers, triggering a housing crisis that displaced thousands of Indigenous clients who’d been scooped up by van, signed up for Medicaid—and dumped when the scam was exposed. The Navajo Nation declared a state of emergency. Officials estimate Arizona’s behavioral health billing scandal cost taxpayers $2.8 billion.

If you’re wondering whether this qualifies as health care or human trafficking with a spreadsheet, you’re not alone.

And while most providers at least pretend to offer treatment, some don’t bother. In North Carolina, Southeastern Behavioral Healthcare Services billed Medicaid for counseling services provided to patients who were either in jail—or in the ground. “Is that ‘treatment’ by psychiatrists or psychics?” Freedom Magazine drily but pointedly asked in a December 2024 article. The fraud was so brazen—and so prolonged—that federal prosecutors forced the company into a multimillion-dollar fine and a compliance agreement.

The mental health fraud boom is driven by lax oversight, gaping loopholes and perverse incentives.

Meanwhile, in Connecticut, Dr. Naimetulla Ahmed Syed, dubbed “addicts’ favorite psychiatrist-dealer,” managed to avoid jail entirely. Though he repeatedly defrauded Medicare and Medicaid, wrote excessive prescriptions and kept his own records suspiciously blank, Syed got away with a fine—and kept his medical license until he decided to retire.

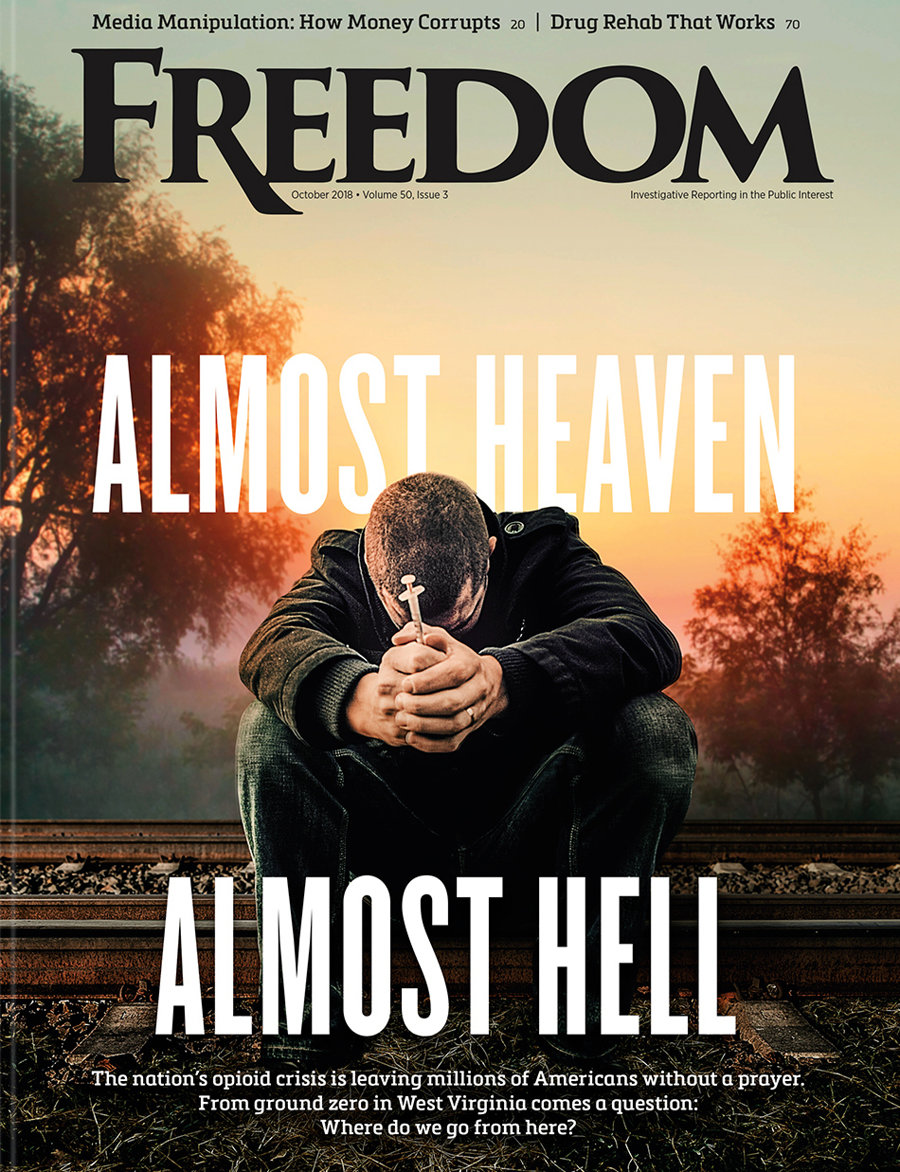

“We have all seen firsthand the devastation wrought by the opioid and addiction crisis—the thousands of grieving families across Connecticut with empty seats at their holiday tables,” Attorney General William Tong said, adding: “We will not hesitate to use every ounce of our authority to hold accountable the individuals and entities who have perpetuated and profited from this epidemic.”

So-called sober homes and fake counseling centers are also major culprits in the Medicaid grift machine. In Connecticut, one operator billed Medicaid for therapy sessions she never conducted—a blessing in disguise, given that she faked her credentials. Others rented out their billing numbers for kickbacks. In one particularly creative case, Medicaid funds went to a business named “Minds Cornerstone,” which claimed to offer behavioral services to autistic children. The operator was already in prison for fraud—yet still managed to run the scam under a pseudonym. The losses topped $1.8 million.

In every state, the same pattern emerges: Vulnerable people—addicts, the “mentally ill,” the homeless, Indigenous populations—are turned into walking invoices. They’re harvested for their Medicaid eligibility and discarded when the audits come.

Even when busted, many perpetrators face wrist-slap consequences. A two-year suspended sentence here, a fine there. Jail time, when it comes, is often short. And the dirty money? Usually already spent.

The mental health fraud boom is driven by lax oversight, gaping loopholes and perverse incentives. Medicaid reimburses based on billing codes, not outcomes. Providers are trusted to self-report. Regulators are understaffed. And as Mark Schiller, president of the American Association of Physicians and Surgeons, admits: “I have frequently seen psychiatrists diagnose patients with a range of psychiatric diagnoses that aren’t justified” to secure reimbursements.

Citing the widespread abuse he encountered in the behavioral health field while serving as inspector general at the US Department of Health and Human Services for 11 years, Richard Kusserow said, “Psychiatrists and psychologists have the worst fraud record of all medical disciplines.”

Back in Minnesota, NUWAY insists it broke no laws. Its lawyer, David Glaser, even lamented the “lack of due process” available to Medicaid providers when payments are suspended, suggesting lawmakers change the system to let them plead their case before the money gets cut off. “Concerns about fraud are entirely legitimate,” he said, “but due process is an essential American principle.”

True—but so is protecting the public purse. And when that purse is bleeding billions a year to ghost clinics, pill-mill doctors and dead-patient billing scams, the burden of proof shouldn’t fall on the taxpayers. It should fall on those asking to be trusted—with money, with care and with people’s lives.

NUWAY may not be the worst actor in this saga, but it’s part of a deeply broken system where fraud isn’t the exception—it’s the business model. Until regulators, lawmakers and licensing boards start treating psychiatric fraud like the organized criminal enterprise it often is, the con will continue.

Because what better racket than selling fake care to people who need real help—and offloading the bill to someone else? After all, it turns out that the most reliable treatment in America’s behavioral health marketplace isn’t therapy or recovery. It’s grift.